The Luxury Innovation Center is a premier hub for jewelry, precious stones, metals, and luxury innovation businesses — bringing together over 1,500 professionals and companies through high-level programmes such as masterclasses, roundtables, membership activities, and global events.

As the Center grew, so did the administrative load: membership invoicing, event fees, academic programme payments, and vendor reconciliation were all being handled manually — resulting in delays, errors, and operational overhead.

Challenge

Before Pinto, the team faced several operational challenges:

Manual invoicing: Membership renewals and event fees were managed through spreadsheets and emails.

Payment tracking issues: Following up on unpaid memberships required repetitive reminders.

Scattered financial data: Memberships, event tickets, and vendor costs were tracked separately, causing inconsistencies.

Lack of real-time visibility: Financial overviews required manual reporting each month.

Solution: How Pinto Transformed LIC’s Financial Operations

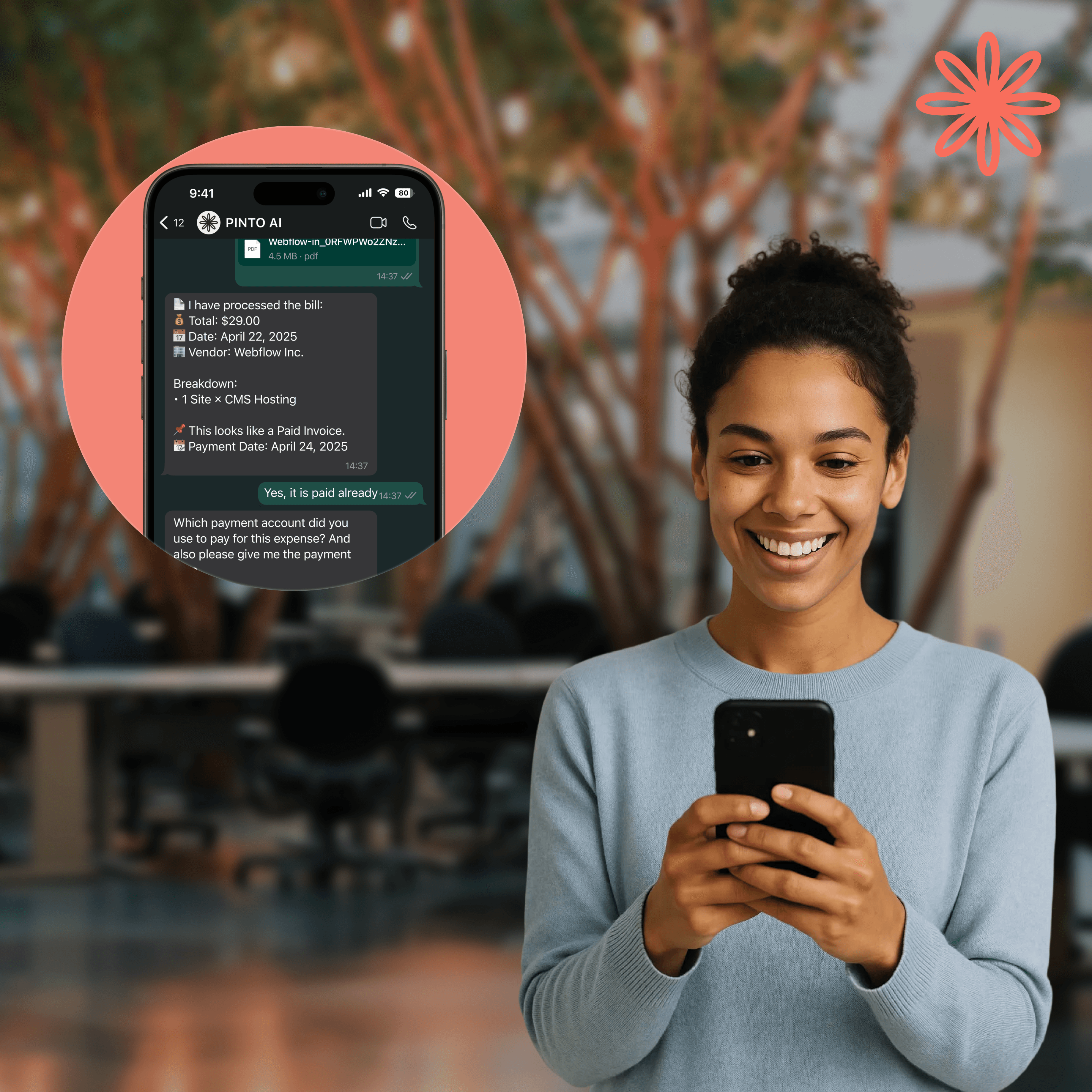

LIC integrated Pinto into their daily workflow to automate finance operations, unify data, and reduce manual work. Pinto now acts as their virtual finance assistant — always accessible, fast, and accurate.

Here’s how Pinto transformed their operations:

Automated Membership & Event Invoicing

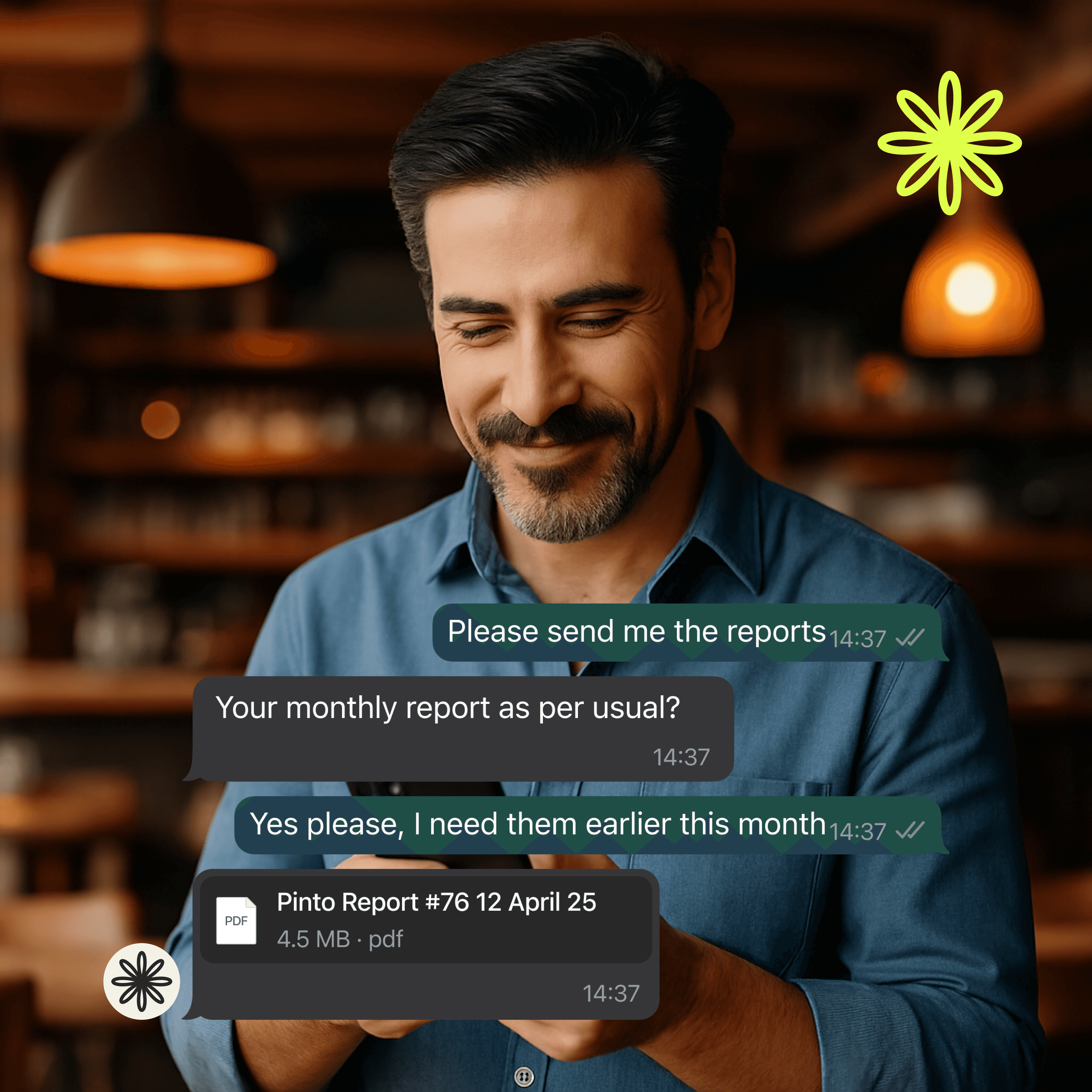

Membership renewals and event payments were previously handled manually. Now, the LIC team simply sends a WhatsApp message like:

“Create an invoice for AED 2,500 annual membership for John Smith.”

Pinto instantly generates a VAT-compliant invoice, sends it to the member, and logs it in the accounting system.

Impact

Invoices created in under 1 minute

Automatic reminders for unpaid fees

Centralized record-keeping for all transactions

Effortless Vendor Expense Logging

LIC often works with multiple vendors — from event caterers to venue providers and designers. Instead of saving and filing receipts manually, the team simply sends photos of receipts to Pinto via WhatsApp.

Pinto’s OCR technology extracts and records all details (vendor, date, amount, category) automatically.

Impact

Eliminated manual data entry

Improved accuracy and transparency

Consolidated all vendor expenses in one place

VAT Compliance & Automated Reporting

With varied income sources (memberships, sessions, sponsorships), VAT preparation used to be a monthly burden.

Pinto now continuously classifies transactions and generates VAT-ready reports formatted for the UAE’s FTA. It also sends automated VAT reminders to avoid fines or missed filings.

Impact

VAT preparation time reduced by 80%

Zero missed deadlines or compliance issues

Full confidence during VAT submissions

Seamless Integration & Security

Pinto integrates securely with Wafeq, LIC’s accounting tool, ensuring all invoices, expenses, and reports are synced automatically.

All data transfers are encrypted and compliant with UAE data protection laws.

Impact

100% secure data handling

No duplication or mismatched records

Zero dependency on manual exports

Results

55 %

Less admin time

Faster payments

Thanks to automated follow-ups

Full visibility

Over memberships, events, and vendors in one place

Better experience

for members and partners — smoother, more professional processes

Margot

Co-founder, Luxury Innovation Center

“Managing memberships, events, and programs used to take a huge amount of admin time. With Pinto, everything is organized, automated, and accessible on WhatsApp. It’s incredibly efficient — and a game-changer for us.”

Trusted by 70+ UAE SMEs across consulting, SaaS, and professional services

Zoho Books and Wafeq

Integrated with , fully VAT-compliant

5–8 Hours Saved Weekly

Per User, With 70% Higher Data Accuracy